E-Invoicing in the UAE – A Complete Guide for Your Business

The UAE is moving toward a fully digital tax and invoicing system, and e-invoicing is a major part of that transformation. By July 2026, every business registered for VAT in the UAE will be required to issue and receive invoices electronically, using a structured format approved by the Federal Tax Authority (FTA). (Ministry of Finance)

This reform aims to create an efficient, transparent, and secure system that benefits both businesses and regulators. Businesses that prepare early will avoid disruptions, reduce costs, and position themselves for smoother operations in the future

What Exactly Is E-Invoicing?

E-invoicing in the UAE is the electronic creation, exchange, and storage of invoices in a standardized digital format, with real-time validation by the Federal Tax Authority (FTA) to ensure VAT compliance and prevent fraud.

Unlike traditional paper or PDF invoices, an e-invoice in the UAE is generated in a machine-readable format (XML or UBL) that is instantly processed, validated, and stored by FTA-accredited platforms.

In simple terms:

- A supplier creates an invoice in their system.

- The invoice is automatically validated through an Accredited Service Provider (ASP).

- The buyer receives it, and a copy is securely sent to the FTA in real time.

This ensures accuracy, faster processing, and compliance with UAE VAT law.

This process makes invoices tamper-proof, transparent, and immediately usable for tax and accounting purposes.

Why Is the UAE Introducing E-Invoicing?

The UAE government introduced mandatory e-invoicing as part of its digital transformation strategy to strengthen VAT compliance, prevent tax evasion, and align the country with global best practices in electronic invoicing.

E-invoicing benefits both businesses and the government by streamlining operations and ensuring compliance and transparency.

Legal Framework and Timeline

The UAE e-invoicing system is being implemented in phases, with voluntary adoption between 2024 and 2025 and mandatory e-invoicing for all B2B and B2G transactions from July 2026 under Federal Decree-Law No. 16 of 2024.

- Federal Decree-Law No. 16 of 2024 – Updated VAT law to accommodate e-invoicing.

- Federal Decree-Law No. 17 of 2024 – Amended Tax Procedures Law to include compliance and penalties.

Implementation Timeline:

- 2024 – 2025: System testing, accreditation of service providers, voluntary adoption.

- July 2026: Mandatory adoption for all B2B (business-to-business) and B2G (business-to-government) transactions.

- Future Expansion: Possible extension to B2C (business-to-consumer) invoices.

This timeline makes it clear that waiting until 2026 is risky. It is advisable for businesses to commence system upgrades and training at this time.

Traditional Invoicing vs. E-Invoicing – Key Differences

To better understand why this transition matters, let’s compare the two approaches:

This comparison highlights why the UAE is mandating e-invoicing: it is faster, more secure, reduces VAT reporting errors, and ensures compliance with FTA regulations while cutting operational costs.

How the E-Invoicing System Works (Step by Step)

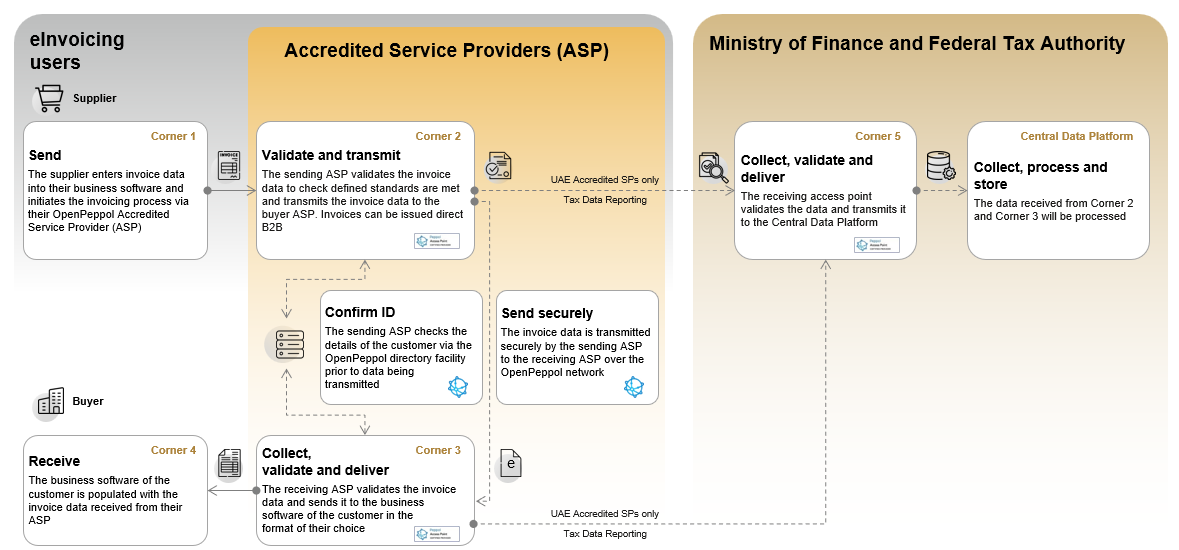

The UAE uses the 5-corner model, which includes the supplier, buyer, service providers, and the FTA. Here’s how it works:

- Supplier issues invoice in digital format.

- Supplier’s ASP validates the invoice and shares it with the FTA.

- Buyer’s ASP receives the validated invoice.

- FTA stores the invoice data for tax and audit purposes.

- Both supplier and buyer receive confirmations, reducing disputes and delays.

Source: UAE Ministry of Finance

The UAE’s 5-corner e-invoicing model ensures every invoice is validated by an Accredited Service Provider (ASP), reported to the FTA in real time, and securely stored with full traceability, eliminating duplication and fraud.

Benefits of E-Invoicing for Businesses

In the UAE, e-invoicing provides businesses with guaranteed VAT compliance, reduced processing costs, faster payments, and enhancedE-invoicing in the UAE offers businesses guaranteed VAT compliance, reduced processing costs, faster payments, and improved financial visibility through real-time structured data.

Challenges Businesses May Face

Even though the UAE e-invoicing rule has long-term advantages, businesses might run into problems like needing to upgrade their ERP systems, train employees, connect with FTA-approved service providers, and meet stricter

- System upgrades – Businesses may need to update or replace their ERP/accounting software to support XML/UBL.

- Training requirements – Employees must learn how to create, validate, and track e-invoices.

- Cost of transition – Initial setup and integration may require investment.

- Choosing the right ASP – Finding a reliable, FTA-accredited service provider is crucial.

- Cybersecurity concerns – Digital systems must be protected against data breaches.

These challenges are temporary, and businesses that prepare early will avoid last-minute disruptions.

What Businesses Should Do Now!

The move toward a fully digital invoicing system reflects the UAE’s commitment to innovation, transparency, and global competitiveness. Businesses that delay risk disruption, but those that act now will enjoy smoother workflows, stronger compliance, and long-term savings. To comply with UAE e-invoicing regulations, businesses should begin early by upgrading ERP/accounting systems, selecting an FTA-accredited service provider, training finance teams, and piloting e-invoices ahead of the July 2026 deadline.